Traditional: ★★★☆☆

AI-Powered: ★★★★☆

Notta.ai: ★★★★☆

The Evolution of Earnings Call Analysis: Traditional Software vs. AI-Powered Tools vs. Notta.ai

Saving time and effort with Notta, starting from today!

Introduction

Earnings calls represent critical touchpoints in the financial calendar, offering analysts a window into a company's performance, strategic direction, and management's outlook. For financial analysts, equity analysts, and research analysts, these quarterly events provide essential insights that inform investment decisions, valuation models, and market recommendations. However, the sheer volume of information presented during these calls—often lasting an hour or more—creates a significant challenge for professionals who need to quickly extract, analyze, and act upon key data points.

The landscape of tools designed to help analysts navigate earnings calls has evolved dramatically over the past decade. What began as simple recording and transcription services has transformed into sophisticated platforms leveraging artificial intelligence, natural language processing, and machine learning to not only transcribe but also analyze, summarize, and extract insights from these crucial financial events.

This comprehensive analysis examines the evolution of earnings call software, comparing traditional platforms with newer AI-powered solutions, and specifically highlighting how Notta.ai has entered this space with its own unique capabilities. We'll explore the functionality, usability, accuracy, pricing, and integration capabilities of each category, providing real-world use cases to illustrate how different types of analysts might leverage these tools to enhance their workflow and decision-making processes.

As earnings calls continue to grow in importance within the financial ecosystem, the tools analysts use to process this information will play an increasingly vital role in maintaining competitive advantage. Whether you're an individual analyst managing multiple calls during busy earnings seasons, part of a larger research team needing collaborative features, or a portfolio manager seeking high-level insights across numerous companies, understanding the strengths and limitations of available software options is essential for optimizing your analytical workflow.

Join us as we navigate the complex landscape of earnings call software, from established traditional platforms to cutting-edge AI solutions, and discover how these

tools are reshaping the way financial professionals extract value from one of the market's most important information sources.

Traditional Earnings Call Software: The Foundation of Financial Analysis

Evolution and Core Capabilities

Traditional earnings call software platforms emerged as essential tools for financial professionals seeking to efficiently access, review, and analyze company earnings announcements. These platforms primarily focused on providing reliable access to earnings call transcripts, audio recordings, and supplementary materials like slide decks and press releases. Their primary value proposition centered on consolidating these resources in one accessible location, saving analysts the time and effort of hunting down information across multiple corporate websites.

The development of these platforms represented a significant improvement over the previous status quo, where analysts would need to dial into conference calls live, take manual notes, and wait days for official transcripts to become available. By providing organized archives of earnings information, traditional platforms enabled more systematic and comprehensive analysis of corporate financial communications.

Key Players in the Traditional Space

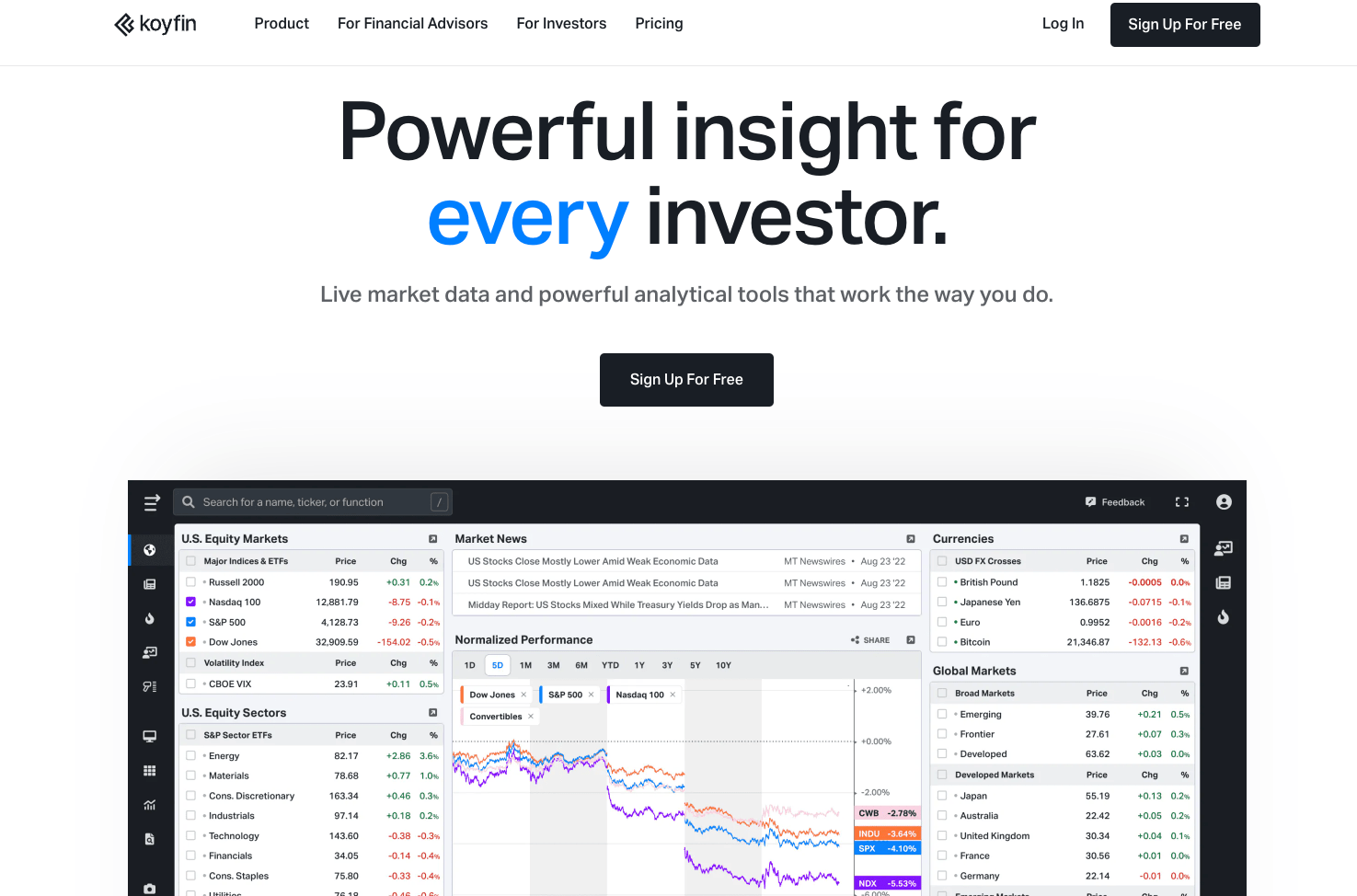

Koyfin

Koyfin stands out as a comprehensive financial research platform with robust earnings call transcript capabilities. Its global coverage spans approximately 100,000 stocks, making it one of the most extensive resources for international earnings information.

Key Features:

Global coverage of ~100,000 stocks

Advanced search capabilities - Searchable transcript library

Filter by ETF constituents

Earnings calendar with integrated transcripts

Tailored watchlist filings and transcripts feed

Downloadable transcripts

Mobile app with transcript access

Multiple event types (earnings calls, analyst days, conferences, M&A calls, special calls)

Pricing:

Free: Limited access with 45-day history

Plus: $39/month

Pro: $79/month

Enterprise Plan: Custom pricing

Koyfin's strength lies in its comprehensive coverage and integration with other financial analysis tools, making it a one-stop solution for analysts who need to combine earnings call insights with other market data.

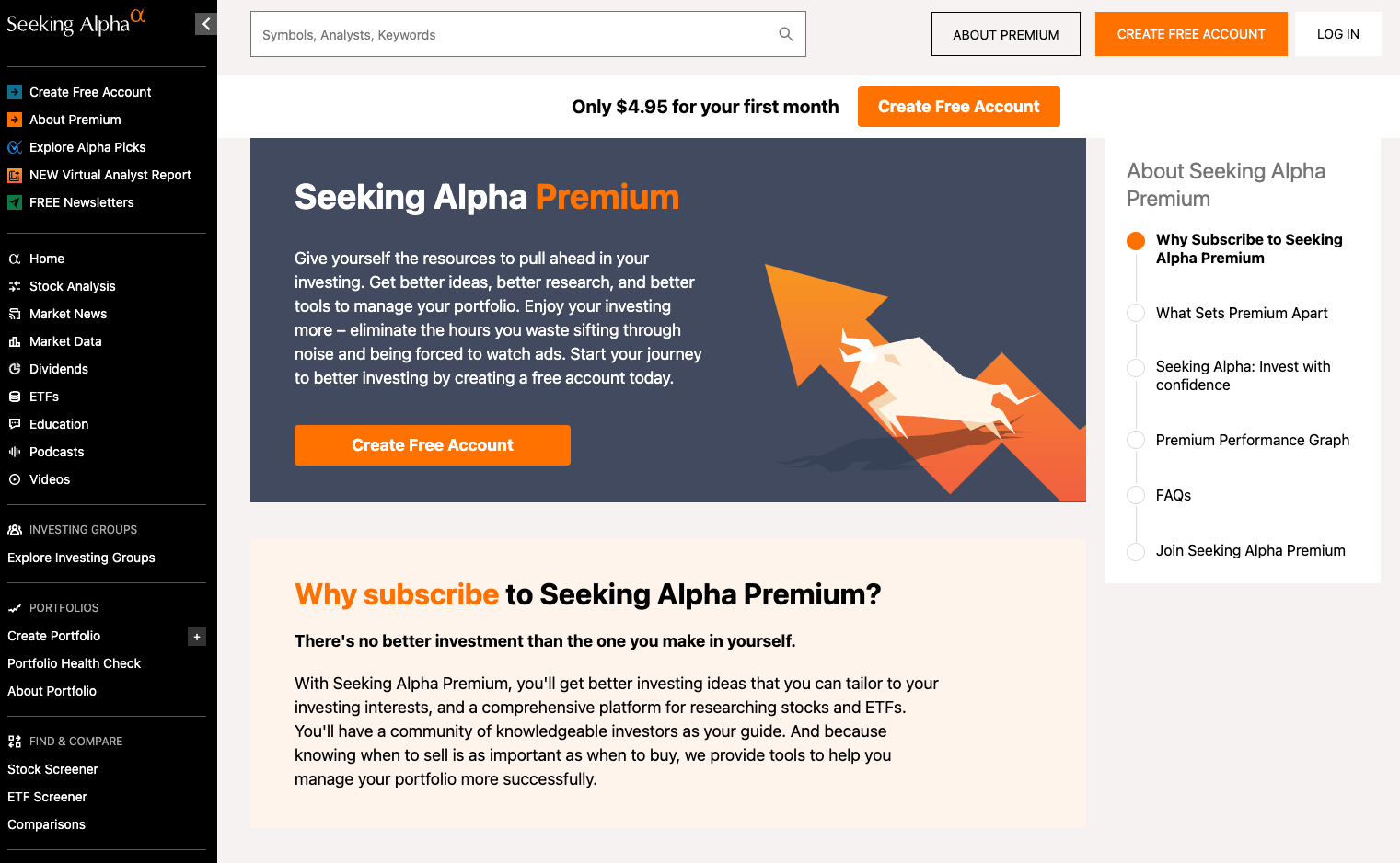

Seeking Alpha

Seeking Alpha focuses primarily on U.S. stocks with coverage of approximately 17,000 companies. The platform is known for its community of contributors who provide analysis alongside official company materials.

Key Features:

U.S. stock coverage (~17,000 stocks)

Speaker annotation in transcripts

Downloadable transcripts

Mobile app with transcript access

Multiple event types coverage

Pricing: - $239/year

While more limited in global coverage than Koyfin, Seeking Alpha offers value through its integration of community analysis with official transcripts, providing multiple perspectives on earnings information.

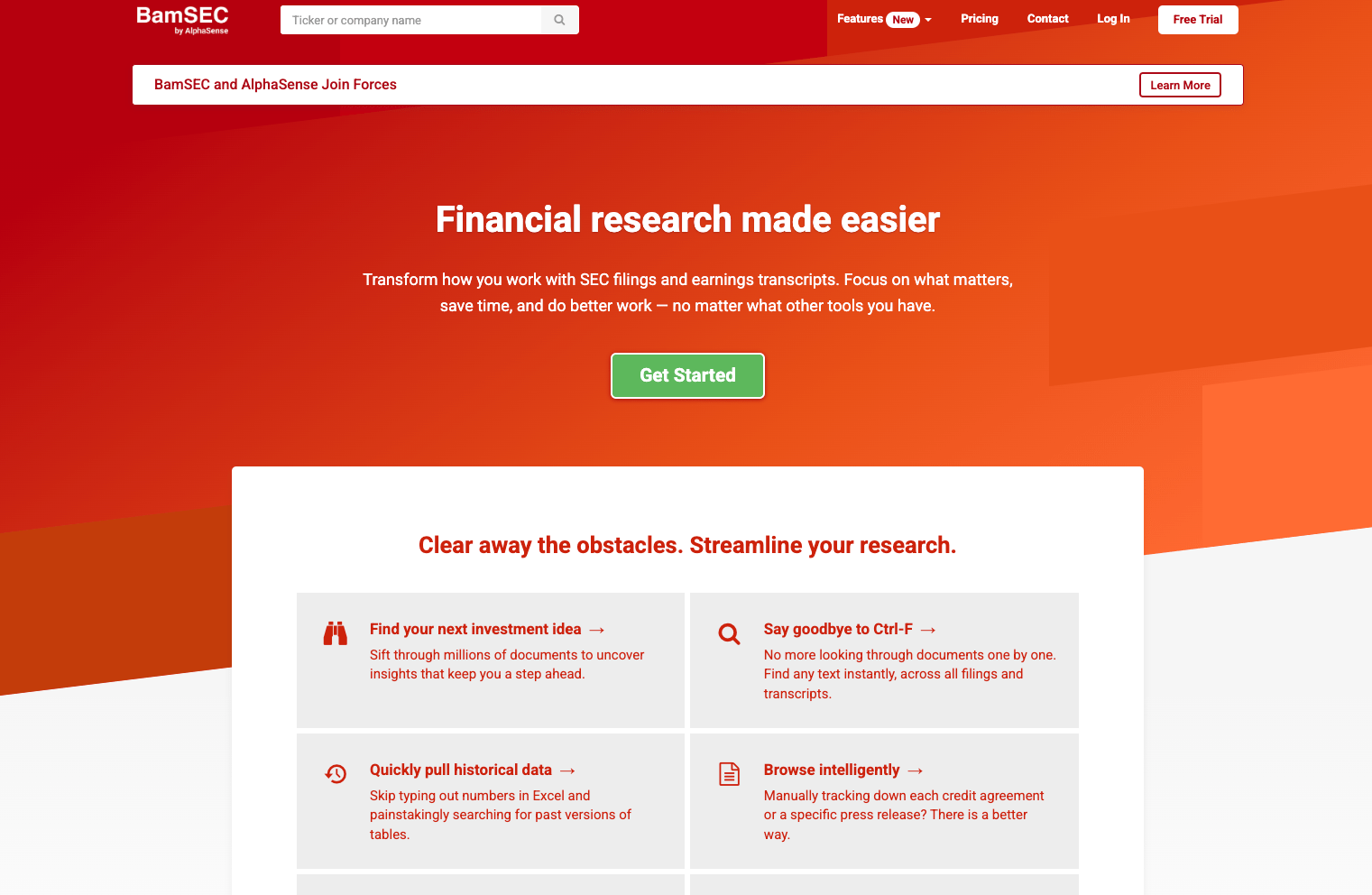

BamSEC

BamSEC specializes in SEC filings and related documents, including earnings call transcripts, with a focus on search and analysis capabilities.

Key Features:

U.S. stock coverage (~17,000 stocks)

Advanced search functionality

Keyword search capabilities

Searchable document library

Speaker annotation

Downloadable transcripts

Multiple event types coverage

Pricing: - $69/month

BamSEC's strength is its powerful search capabilities, allowing analysts to quickly locate specific information across multiple earnings calls and related documents.

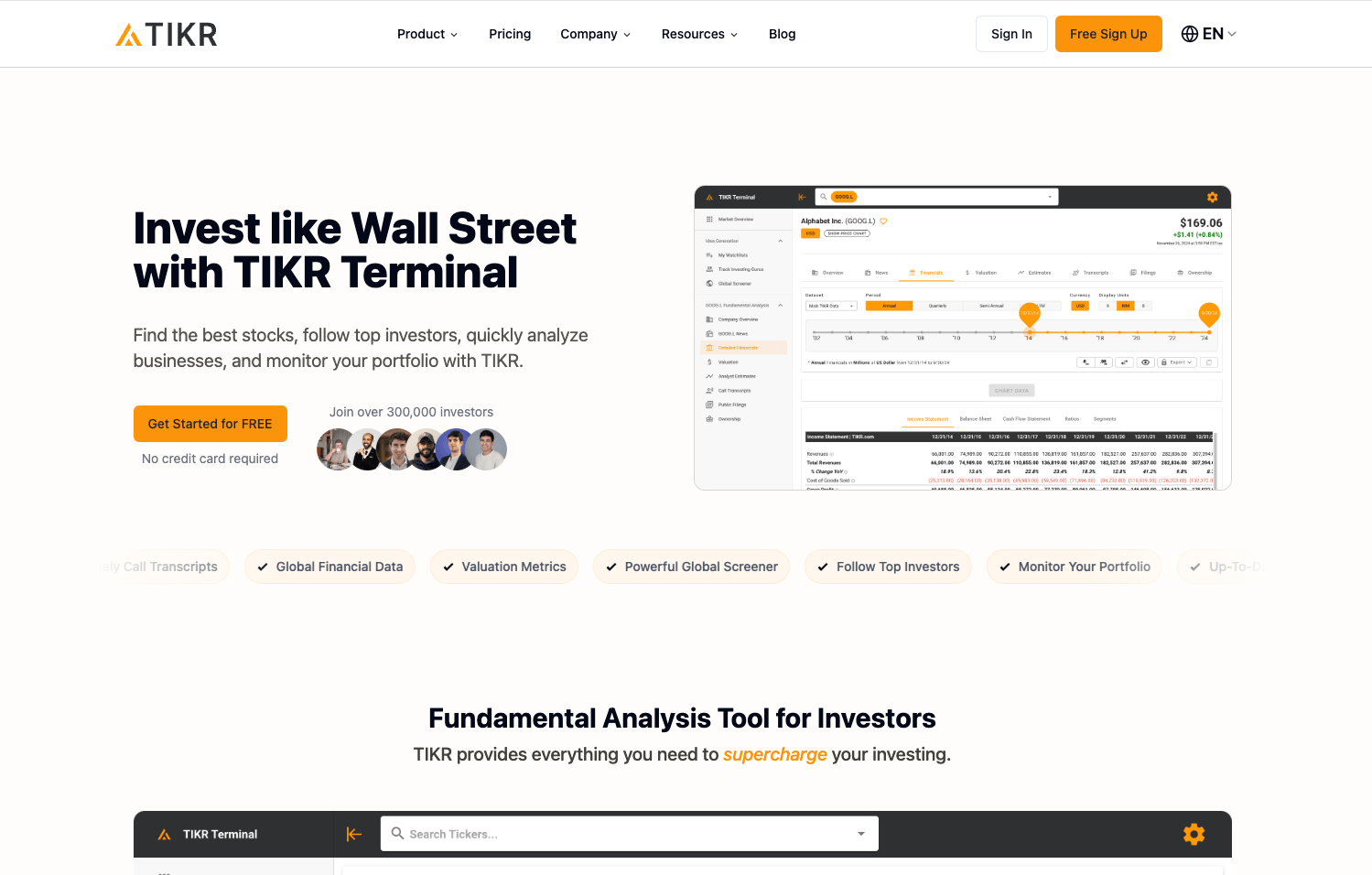

TIKR

TIKR offers global coverage similar to Koyfin but with a different feature set focused on integrating financial data with transcripts.

Key Features:

Global coverage (~100,000 stocks)

International transcripts

Speaker annotation

Multiple event types coverage

Pricing: - $0 - $40/month

TIKR's competitive pricing and global coverage make it attractive for analysts needing international earnings information without premium features.

Other Notable Platforms

MarketBeat provides earnings call transcripts as part of its broader financial data services, though with more limited features compared to specialized platforms.

Finchat offers earnings call transcripts with a focus on chat-based interfaces for financial information.

The Motley Fool provides earnings call transcripts as part of its investment research services, though with more limited features compared to dedicated platforms.

Strengths of Traditional Platforms

Traditional earnings call software platforms excel in several key areas that have made them staples in the financial analyst's toolkit:

Comprehensive Archives: These platforms maintain extensive historical archives of earnings calls, often dating back several years, allowing for longitudinal analysis of company performance and management communication.

Integration with Financial Data: Many traditional platforms integrate earnings call information with other financial data points, such as stock prices, financial statements, and analyst estimates, providing context for the qualitative information shared during calls.

Reliability and Consistency: These established platforms have refined their processes over years of operation, resulting in consistent formatting, organization, and delivery of earnings information.

Specialized Financial Focus: Built specifically for financial professionals, these platforms understand the unique needs of their user base, offering features tailored to financial analysis workflows.

Regulatory Compliance: Traditional platforms typically maintain strict compliance with financial regulations regarding the handling and distribution of market- sensitive information.

Limitations of Traditional Approaches

Despite their strengths, traditional earnings call software platforms face several limitations in today's fast-paced financial environment:

Manual Analysis Required: While these platforms provide access to transcripts, the actual analysis of content remains largely manual, requiring analysts to read through lengthy documents to extract key insights.

Time-Intensive Process: Reviewing complete earnings call transcripts, which often run 20-30 pages, requires significant time investment, particularly during busy earnings seasons when dozens of companies report simultaneously.

Limited Insight Extraction: Traditional platforms generally lack automated tools for extracting themes, sentiment, or key metrics mentioned during calls, leaving this analytical heavy lifting to the user.

Minimal AI Capabilities: Most traditional platforms have been slow to incorporate advanced AI features for content analysis, summarization, or pattern recognition across multiple calls.

Text-Centric Approach: The focus on text transcripts often neglects valuable information conveyed through tone, emphasis, and other audio cues during the actual calls.

Use Case: Traditional Platforms in Practice

Consider Sarah, a senior equity analyst covering the technology sector. During a typical earnings season, she needs to analyze reports from 25 companies in her coverage universe within a two-week period. Using a traditional platform like Koyfin, her workflow might look like this:

She accesses the earnings calendar to plan which calls to prioritize based on reporting dates.

For each company, she downloads the transcript and supporting materials.

She manually reads through each transcript, highlighting key sections and making

notes.

She extracts relevant metrics and management commentary to update her

financial models.

She compares current commentary with previous quarters by searching through

historical transcripts.

She synthesizes this information into a research report for clients.

While the traditional platform provides all the necessary information, Sarah still spends approximately 2-3 hours per company on this process—totaling 50-75 hours of intensive work during the earnings season. This time-intensive approach, while thorough, limits the number of companies she can effectively cover and delays the delivery of insights to clients.

As we'll see in the next section, AI-powered tools have emerged specifically to address these limitations, offering new ways to accelerate and enhance the earnings call analysis process.

The AI Revolution in Earnings Call Analysis

The introduction of artificial intelligence to earnings call analysis represents a paradigm shift in how financial professionals process and extract value from these critical information sources. Unlike traditional platforms that primarily focus on providing access to transcripts, AI-powered tools actively process the content to generate insights, identify patterns, and highlight key information that might otherwise require hours of manual review.

This transformation has been driven by advances in several key technologies:

Natural Language Processing (NLP): Enables machines to understand and interpret human language, including financial terminology and the nuanced language often used by executives.

Machine Learning: Allows systems to identify patterns across multiple earnings calls, improving accuracy and relevance of insights over time.

Large Language Models (LLMs): Provides sophisticated understanding of context and relationships between concepts mentioned during earnings discussions.

Sentiment Analysis: Detects emotional tones and confidence levels in management statements, offering insights beyond the literal content.

These technologies combine to create tools that don't just present information but actively help analysts interpret and prioritize it, dramatically reducing the time required to extract actionable insights from earnings calls.

Leading AI-Powered Platforms

Focal

Focal leverages NLP to extract key insights from financial documents, including earnings call transcripts.

Key Features:

NLP-powered insights from financial documents

Real-time monitoring of market trends and sentiment

Regulatory compliance monitoring

Sentiment analysis of financial texts

Standout Feature:

NLP analysis

Best For: Compliance tracking

Value Proposition: Focal reduces analysis time from days to seconds while identifying patterns and anomalies that human analysts might miss.

Hudson Labs

Hudson Labs specializes in AI trained specifically on corporate financial language, with a focus on accurate analysis of earnings calls.

Key Features:

AI trained on 8M+ pages of corporate jargon

Quick earnings call summaries

AI-powered investment memos

Specialized news feeds

Identification of related party risk, customer concentration, and management team history

Standout Feature: Corporate-trained AI

Best For: Accurate company analysis

Value Proposition: Hudson Labs serves clients managing over $600 billion in assets with highly accurate financial analysis that outperforms general AI tools.

Aiera

Aiera focuses on real-time earnings call analysis with live audio capabilities and DVR-like controls.

Key Features:

Live audio with DVR controls

Real-time transcription (less than 1 second delay, 97% accuracy)

AI Q&A capabilities

Advanced summarization

Coverage of 60,000+ public investor events yearly

Tracking of 13,000+ global stocks

Standout Feature: Live audio with DVR

Best For: Juggling multiple calls

Value Proposition: Aiera enables analysts to monitor multiple earnings calls simultaneously during busy earnings seasons.

AlphaSense

AlphaSense offers AI-powered search and analysis across financial documents, including earnings call transcripts.

Key Features:

Smart Summaries with ranked bullet points

Key topics, guidance, and competitive information extraction

Highlights from analyst questions

Clickable citation links for source verification

Custom LLMs trained on financial data

Standout Feature: Ranked summaries

Best For: Deep dives into transcripts

Value Proposition: AlphaSense saves analysts 2-15 hours monthly on checking non-core companies and 2-14 hours on writing post-earnings recaps.

Quartr AI Assistant

Quartr AI Assistant provides comprehensive coverage of global companies with customizable features.

Key Features:

Coverage of 10,000+ global companies

Customizable calendar

Mobile app and API access

Collaboration features for team notes and highlights

Standout Feature: Customizable calendar

Best For: Global company coverage

Value Proposition: Quartr provides comprehensive access to earnings calls, transcripts, filings, and slide decks for global market research.

FactSet Transcript Assistant

FactSet integrates AI transcript analysis within its broader financial data platform.

Key Features:

Chatbot interface for transcript interaction

Integration with FactSet's financial data platform

Conversational AI for transcript analysis

Standout Feature: Chatbot interface

Best For: FactSet platform users

Value Proposition: FactSet Transcript Assistant enables users to chat with transcripts and extract insights through natural language queries.

ChatGPT and General-Purpose AI

Beyond specialized platforms, general-purpose AI tools like ChatGPT are increasingly being used for earnings call analysis.

Key Features:

Generalist model for text analysis

Ability to process and summarize transcripts

Question-answering capabilities

Limitations:

Lacks specialized financial training

May struggle with financial jargon and context

Limited accuracy with complex financial content

Value Proposition:

While accessible and versatile, general-purpose AI like ChatGPT has limitations when working with specialized financial content compared to purpose-built solutions.

Transformative Capabilities of AI-Powered Tools

AI-powered earnings call tools offer several capabilities that fundamentally transform how analysts interact with earnings information:

Automated Summarization: These tools can distill hour-long calls into concise summaries highlighting key points, saving analysts significant time during busy earnings seasons.

Sentiment Analysis: By analyzing tone, word choice, and context, AI tools can assess management confidence and sentiment beyond what's explicitly stated.

Pattern Recognition: AI can identify recurring themes or changes in messaging across multiple quarters, spotting trends that might be missed in isolated reviews.

Key Metric Extraction: These platforms automatically identify and extract important financial metrics mentioned during calls, organizing them for easy reference.

Cross-Company Comparison: Advanced AI tools can compare language and metrics across peer companies, providing competitive insights.

Question Analysis: Some tools specifically analyze the Q&A portion of calls, highlighting challenging questions and management responses.

Time Efficiency: What might take an analyst hours to process manually can be accomplished in minutes with AI assistance.

Advantages Over Traditional Platforms

AI-powered tools offer several distinct advantages compared to their traditional counterparts:

Speed: AI tools can process and analyze earnings calls in a fraction of the time required for manual review.

Scalability: Analysts can effectively monitor many more companies using AI tools, expanding their coverage universe.

Consistency: AI applies the same analytical framework to every call, eliminating human inconsistencies or biases.

Pattern Detection: AI excels at identifying subtle patterns across multiple calls that human analysts might miss.

Depth of Analysis: These tools can simultaneously analyze multiple dimensions of calls, from financial metrics to management tone.

Resource Optimization: By automating routine analysis, AI tools free analysts to focus on higher-value interpretative work.

Limitations and Challenges

Despite their advantages, AI-powered earnings call tools face several challenges:

Accuracy with Specialized Terminology: Some AI systems struggle with industry- specific jargon or newly coined terms.

Context Understanding: AI may miss important contextual nuances that human analysts would recognize.

Over-reliance Risk: There's a danger that analysts might over-trust AI outputs without appropriate verification.

Training Requirements: Many AI systems require ongoing training to maintain accuracy as language and business environments evolve.

Cost Barriers: Sophisticated AI platforms often come with premium pricing that may be prohibitive for smaller firms or individual analysts.

Use Case: AI-Powered Analysis in Practice

Returning to our example of Sarah, the senior equity analyst covering the technology sector, let's see how her workflow changes with an AI-powered platform like Hudson Labs:

She still uses the earnings calendar to plan her coverage, but now the AI automatically flags calls with unusual language or significant deviations from previous quarters.

Instead of reading entire transcripts, she begins with AI-generated summaries that highlight key metrics, management tone, and significant announcements.

The AI tool automatically extracts relevant financial metrics and compares them to previous quarters and analyst expectations.

Pattern recognition features alert her to changes in management language around key business segments compared to previous quarters.

The sentiment analysis helps her gauge management confidence in forward- looking statements.

She uses the AI chatbot to ask specific questions about the transcript, such as "What did the CEO say about the new product launch timeline?"

With this AI-assisted workflow, Sarah reduces her per-company analysis time from 2-3 hours to approximately 30-45 minutes—a 75% reduction. This efficiency allows her to either expand her coverage universe or spend more time on deeper analysis of key companies. Additionally, the AI helps her identify subtle patterns and shifts that might have been missed in a manual review.

The transformation is clear: while traditional platforms provide access to information, AI-powered tools actively help process and interpret that information, fundamentally changing how analysts interact with earnings call content.

Notta.ai: A Versatile Contender in the Earnings Call Analysis Space

Introduction to Notta.ai

While not exclusively designed for earnings call analysis, Notta.ai has emerged as a versatile AI-powered transcription and analysis tool that offers significant capabilities for financial professionals seeking to streamline their earnings call workflow. Originally developed as a general-purpose transcription and note-taking solution, Notta.ai's feature set makes it increasingly relevant for financial analysts, equity analysts, and research analysts who need to process and extract insights from earnings calls efficiently.

Notta.ai leverages automatic speech recognition (ASR) technology combined with artificial intelligence to convert audio into text with high accuracy, while also providing analytical capabilities that help users identify key information and insights from the transcribed content. Its multilingual capabilities and integration options further enhance its utility in the global financial analysis landscape.

Core Capabilities for Earnings Call Analysis

High-Accuracy Transcription

At its foundation, Notta.ai offers powerful transcription capabilities that are directly applicable to earnings call analysis:

Accuracy Rate: Notta.ai claims up to 98.86% accuracy in its transcriptions, which is crucial for financial analysis where precise wording can have significant implications.

Speaker Identification: The platform automatically distinguishes between different speakers, essential for separating analyst questions from management responses during earnings calls.

Timestamps: Automatic time-stamping makes it easy to reference specific points in the call for further analysis or verification.

Real-Time Capabilities: Notta.ai can transcribe live earnings calls as they happen, providing immediate access to the information being discussed.

Multilingual Support

In an increasingly global financial market, Notta.ai's language capabilities offer significant advantages:

58 Languages Supported: Transcription is available across 58 languages, enabling analysis of international companies' earnings calls.

Bilingual Transcription: Available in 11 languages, including Japanese, which is particularly relevant for analysts covering Asian markets.

Translation Features: The ability to translate transcripts expands the range of companies analysts can effectively cover regardless of language barriers.

Customizable Vocabulary: The platform allows customization of vocabulary in English and Japanese, helping improve accuracy with industry-specific terminology.

AI-Powered Analysis

Beyond basic transcription, Notta.ai offers analytical features that help extract value from earnings call content:

Automatic Summarization: AI-generated summaries highlight key points from the call, saving analysts from reading entire transcripts.

Key Takeaway Identification: The platform identifies important statements and action items mentioned during the call.

AI Chatbot: Analysts can query specific aspects of the transcript using natural language questions.

Searchability: Full-text search capabilities make it easy to locate specific topics or metrics mentioned during the call.

Integration and Accessibility

Notta.ai offers several features that help it fit into existing analyst workflows:

Video Conferencing Integration: Direct integration with Zoom, Google Meet, Microsoft Teams, and Webex allows automatic recording and transcription of earnings webcasts.

Calendar Integration: Synchronization with calendar apps enables automatic scheduling of earnings call recordings.

Cross-Device Access: Transcripts can be accessed across desktop and mobile devices, allowing analysts to review earnings information anywhere.

Export Options: Multiple export formats (TXT, DOCX, SRT, XLSX, PDF) facilitate integration with other analysis tools and report generation.

Pricing Structure

Notta.ai offers a tiered pricing model that scales with usage requirements:

Free Plan

120 minutes of transcription per month (limited to 3 minutes per conversation)

50 file uploads per month

10 AI summaries per month

Basic features

Pro Plan

1,800 transcription minutes per month

90 minutes per conversation

100 file uploads per month

30 AI summaries per month

Transcript translation

Business Plan

Unlimited transcription

Up to 5 hours per conversation

200 file uploads per month per seat

50 AI summaries per month

Advanced security features

Salesforce and Zapier integrations

Enterprise Plan (Custom pricing)

Customizable seats and transcription quota

SAML SSO

Custom AI templates and prompts

Audit logs

Priority support

Strengths for Earnings Call Analysis

When applied specifically to earnings call analysis, Notta.ai offers several distinct advantages:

Time Efficiency: Automatically transcribing earnings calls saves analysts hours of manual work, particularly during busy earnings seasons when multiple companies report simultaneously.

Multilingual Capabilities: The extensive language support makes Notta.ai particularly valuable for analysts covering international markets or global companies that conduct earnings calls in multiple languages.

AI-Powered Insights: Automatic summarization and key point extraction help analysts quickly identify the most important information from lengthy earnings calls.

Accessibility: The ability to access transcripts across devices enables analysts to review earnings information while traveling or away from their desks.

Cost-Effectiveness: Compared to some specialized financial platforms, Notta.ai offers competitive pricing while providing many of the core features needed for earnings call analysis.

User Experience: With a 4.6/5 rating on G2 and over 10 million users worldwide, Notta.ai has demonstrated a commitment to user-friendly design and functionality.

Limitations for Earnings Call Analysis

Despite its strengths, Notta.ai has several limitations when compared to specialized earnings call platforms:

Not Finance-Specific: Unlike platforms built exclusively for financial analysis, Notta.ai lacks specialized features for tracking financial metrics or comparing data across companies.

Limited Free Tier: The free version only transcribes the first 3 minutes of any conversation, making it impractical for earnings calls that typically run 45-60 minutes.

No Historical Archive: Unlike traditional financial platforms, Notta.ai doesn't maintain an archive of past earnings calls—analysts must record or upload each call they want to analyze.

Limited Financial Integration: The platform lacks direct integration with financial data sources or analysis tools commonly used by financial professionals.

Accuracy with Financial Terminology: While generally accurate, Notta.ai may struggle with specialized financial terminology or industry-specific jargon without custom vocabulary training.

Use Case: Notta.ai in Earnings Call Analysis

To illustrate how Notta.ai might be used for earnings call analysis, let's consider Michael, a research analyst at a mid-sized investment firm who covers the consumer goods sector:

Michael uses Notta.ai's calendar integration to schedule recordings of upcoming earnings calls for the 15 companies he follows.

During the live calls, Notta.ai automatically transcribes the audio in real-time, allowing Michael to focus on listening for nuance rather than taking notes.

After each call, Michael reviews the AI-generated summary to quickly identify key points and action items.

For deeper analysis, he uses the search function to locate specific mentions of metrics he tracks, such as gross margin or inventory levels.

For a Japanese company in his coverage, he uses the bilingual transcription feature to get both the original Japanese transcript and an English translation.

He exports the key sections of the transcript to include in his research report, along with his analysis of the information.

Using the AI chatbot, he asks questions like "What did the CEO say about supply chain challenges?" to quickly locate relevant information.

With Notta.ai, Michael reduces his per-call processing time by approximately 60% compared to manual methods, allowing him to produce more timely and comprehensive analysis for his clients. While he still uses specialized financial platforms for quantitative analysis, Notta.ai serves as an efficient first step in processing the qualitative information from earnings calls.

Notta offers the most integrated AI meeting notes, summaries, and action items so nothing gets missed.

Comparative Analysis: Traditional vs. AI-Powered vs. Notta.ai

Transcription Capabilities

| Feature | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Real-time Transcription | Limited or None | Available | Yes |

| Accuracy | High | High | Claimed 98.86% |

| Financial Terminology | Excellent | Good | Limited (improving) |

| Speaker Identification | Accurate | Good | Basic |

| Audio/Video Support | Audio only | Audio and basic analysis | Audio & Video transcription |

Language Support

| Feature | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Number of Languages | Limited (mostly English) | Multiple | 58 languages |

| Translation | Minimal | Available (premium) | Translation available |

| Custom Vocabulary | Limited | Available | English & Japanese |

Traditional: ★★★☆☆

AI-Powered: ★★★★☆

Notta.ai: ★★★★★

AI Analysis Features

| Feature | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Summarization | Minimal or none | Automated summaries | AI-generated summaries |

| Sentiment Analysis | None | Available | Not available |

| Key Metrics & Patterns | None | Available | Basic identification only |

| Cross-Call Analysis | None | Available | Not available |

Traditional: ★★☆☆☆

AI-Powered: ★★★★★

Notta.ai: ★★★★☆

Search Capabilities

| Feature | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Keyword Search | Basic | Advanced (semantic) | Basic full-text search |

| Cross-Transcript Search | Limited | Yes | No |

| Semantic Understanding | Limited | Strong | Limited |

Traditional: ★★★☆☆

AI-Powered: ★★★★★

Notta.ai: ★★★☆☆

Data Extraction

| Feature | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Financial Metric Extraction | Manual | Automated | Limited |

| Trend Analysis | Limited | Automated | Limited |

| Competitive Comparison & Guidance | Limited or none | Automated | Not available |

Traditional: ★★☆☆☆

AI-Powered: ★★★★★

Notta.ai: ★★☆☆☆

Customization Options

| Feature | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Vocabulary Customization | Limited | Available | Available |

| Alert Settings | Basic | Customizable | Basic |

| Industry-specific models | Limited | Available | Limited |

Traditional: ★★☆☆☆

AI-Powered: ★★★★☆

Notta.ai: ★★★☆☆

Usability Comparison

| Aspect | Feature | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|---|

| User Interface | Interface Style | Utilitarian | Dashboard-driven | Minimalist & Clean |

| Financial Analysis Focus | Yes | General/Analytical | General-purpose | |

| Learning Curve | Ease of Use | Steeper | Moderate | Gentle (intuitive) |

| Training Required | Usually required | For advanced usage | Minimal | |

| Mobile Accessibility | Mobile Optimization | Limited | Good | Excellent (full-featured) |

| Cross-device Synchronization | Limited | Good | Excellent |

Traditional: ★★☆☆☆

AI-Powered: ★★★★☆

Notta.ai: ★★★★★

Workflow Integration

| Integration Area | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Financial Workflow | Excellent | Strong | General-purpose (limited) |

| CRM Integration | Basic | Strong | Basic (Salesforce available) |

| Video Conferencing | Limited | Strong | Excellent |

| API Availability | Established | Comprehensive | Basic |

| Export Options | Standard | Rich formats | Multiple formats |

Traditional: ★★★★☆

AI-Powered: ★★★★☆

Notta.ai: ★★★☆☆

Accuracy Comparison

| Aspect | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Transcription Accuracy | Very High | High | Claimed 98.86% |

| Speaker Identification | Very High | Good | Basic |

| Financial Term Recognition | Excellent | Good | Improving with training |

| Consistency | Excellent | Good | Depends on audio quality |

| Improvement Over Time | Slow | Rapid | Moderate |

Traditional: ★★★★★

AI-Powered: ★★★★☆

Notta.ai: ★★★★☆

Pricing Comparison

| Pricing Aspect | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Cost Structure | High | Premium-tiered | Competitive, clear tiers |

| Free Tier | Limited or None | Limited | Available (3-min cap per call) |

| Value for Money | Good (expensive) | High (efficiency) | Good general value |

| Scalability | Good (enterprise) | Flexible | Straightforward scaling |

| Hidden Costs | Higher | Moderate | Transparent pricing |

Traditional: ★★★☆☆

AI-Powered: ★★★★☆

Notta.ai: ★★★★☆

Use Case Scenarios

| Scenario | Traditional Platforms | AI-Powered Tools | Notta.ai |

|---|---|---|---|

| Individual Analyst | Moderate | Good | Good (cost-effective) |

| Research Team | Good | Excellent | Moderate (basic collaboration) |

| Portfolio Manager | Moderate | Excellent | Moderate |

| Compliance & Legal Teams | Excellent | Good | Moderate |

Traditional: ★★☆☆☆

AI-Powered: ★★★★☆

Notta.ai: ★★★★★

Future Trends in Earnings Call Analysis

The landscape of earnings call analysis continues to evolve rapidly, driven by technological advancements and changing market demands. Several key trends are likely to shape the future of this space:

Multimodal Analysis

Future tools will increasingly analyze not just what is said during earnings calls, but how it is said:

Visual Analysis: Processing facial expressions and body language from video earnings calls to assess management confidence and truthfulness.

Voice Analysis: Detecting stress patterns, hesitation, or confidence in executive voices beyond the words themselves.

Integrated Analysis: Combining text, audio, and visual data for comprehensive sentiment assessment.

Predictive Analytics

AI tools will move beyond descriptive analysis to predictive capabilities:

Stock Movement Prediction: Correlating language patterns with subsequent stock performance.

Guidance Accuracy Assessment: Analyzing historical accuracy of management forecasts to weight current guidance.

Risk Identification: Flagging potential issues before they materialize based on subtle changes in management communication.

Real-Time Collaborative Analysis

The future will bring more sophisticated collaborative features:

Live Collaborative Annotation: Allowing team members to highlight and comment on earnings calls in real-time.

Integrated Communication: Direct messaging and discussion features within the analysis platform.

Role-Based Insights: Customized analysis views based on team member responsibilities.

Regulatory Integration

As financial regulations evolve, earnings call tools will adapt:

Compliance Automation: Automatic flagging of potential regulatory issues in earnings communications.

Disclosure Tracking: Monitoring required disclosures across multiple earnings periods.

Audit Trail Enhancement: Improved documentation of analysis processes for regulatory review.

Specialized Industry Models

Generic AI models will give way to highly specialized versions:

Industry-Specific Training: AI models trained exclusively on particular sectors like healthcare, technology, or financial services.

Company-Specific Models: Custom AI trained on a company's historical communications for more accurate analysis.

Regulatory-Aligned Models: AI systems designed to align with specific regulatory frameworks like SEC requirements.

Conclusion: Choosing the Right Tool for Your Needs

The evolution from traditional earnings call software to AI-powered tools represents a significant shift in how financial professionals process and analyze critical market information. Each category of tools—traditional platforms, AI-powered solutions, and versatile options like Notta.ai—offers distinct advantages and limitations that make them suitable for different use cases.

Key Considerations for Selection

When selecting an earnings call analysis tool, financial professionals should consider several factors:

Volume of Coverage: How many companies and calls need to be analyzed regularly?

Depth of Analysis Required: Is basic transcription sufficient, or are deeper insights needed?

Integration Requirements: How must the tool fit into existing workflows and systems?

Budget Constraints: What is the available budget for these tools?

Language Requirements: Are multilingual capabilities necessary?

Collaboration Needs: Will multiple team members be using the platform?

Compliance Considerations: Are there specific regulatory requirements to address?

Optimal Use Cases

Based on our comprehensive analysis, certain tools emerge as better fits for specific scenarios:

Traditional Platforms (Koyfin, Seeking Alpha, BamSEC, etc.) are best suited for: - Compliance and legal teams requiring verbatim accuracy - Analysts needing extensive historical archives - Firms with established financial research workflows - Users requiring deep integration with other financial tools

AI-Powered Tools (Focal, Hudson Labs, Aiera, etc.) offer optimal value for: - Investment research teams needing to process numerous calls quickly - Portfolio managers seeking high-level insights across many companies - Analysts focused on identifying patterns across multiple earnings periods - Users willing to invest in premium tools that save significant time

Notta.ai provides particular advantages for: - Individual analysts with budget constraints - Users needing multilingual capabilities - Professionals seeking a balance of automation and affordability - Analysts who value simplicity and ease of use

The Hybrid Approach

Many financial professionals are finding that a hybrid approach—combining tools from different categories—offers the most comprehensive solution:

Using AI-powered tools for initial processing and insight generation

Verifying key information with traditional platforms when necessary

Leveraging versatile tools like Notta.ai for specific use cases like multilingual calls

This combined approach allows analysts to benefit from the strengths of each platform type while mitigating their respective limitations.

Final Thoughts

The earnings call software landscape continues to evolve rapidly, with AI capabilities advancing and traditional platforms incorporating more intelligent features. For financial analysts, equity analysts, and research analysts, staying informed about these tools is increasingly essential to maintaining competitive advantage in information processing.

Whether you opt for the comprehensive archives of traditional platforms, the advanced analytics of AI-powered tools, or the versatile capabilities of solutions like Notta.ai, the right choice ultimately depends on your specific analytical needs, workflow requirements, and resource constraints.

As earnings calls remain a critical information source for financial markets, the tools that help professionals extract maximum value from these events will continue to play an essential role in the investment research ecosystem. By understanding the strengths and limitations of each approach, analysts can select the tools that best support their unique requirements and enhance their analytical capabilities in an increasingly complex financial landscape.